What is factoring?definition,types & procedure.

Factoring is a financing arrangement that is typically used by small and medium-sized businesses to help them maintain a steady cash flow. As every business owner understands, cash flow is important to ensure the successful, continuous operation of their business. This is why it’s important to know the different types of factoring.

In general, factoring means a company is turning over their invoices to a third party in return for receiving a portion of those invoices in cash within a few business days. Primarily, there are two types of factoring, recourse factoring and non-recourse factoring.

Types of Factoring

- Recourse and Non-recourse Factoring: In this type of arrangement, the financial institution, can resort to the firm, when the debts are not recoverable. So, the credit risk associated with the trade debts are not assumed by the factor.

- On the other hand, in non-recourse factoring, the factor cannot recourse to the firm, in case the debt turn out to be irrecoverable.

- If the agreement between the borrower and lender calls for “no recourse” it means the lender has no option to turn to the business owner for any shortfall between what the company owed the lender, and what the liquidated assets provided.

- Disclosed and Undisclosed Factoring: The factoring in which the factor’s name is indicated in the invoice by the supplier of the goods or services asking the purchaser to pay the factor, is called disclosed factoring.

- Conversely, the form of factoring in which the name of the factor is not mentioned in the invoice issued by the manufacturer. In such a case, the factor maintains sales ledger of the client and the debt is realized in the name of the firm. However, the control is in the hands of the factor.

- Domestic and Export Factoring: When the three parties to factoring, i.e. customer, client, and factor, reside in the same country, then this is called as domestic factoring.

- Export factoring, or otherwise known as cross-border factoring is one in which there are four parties involved, i.e. exporter (client), the importer (customer), export factor and import factor. This is also termed as the two-factor system.

- Advance and Maturity Factoring: In advance factoring, the factor gives an advance to the client, against the uncollected receivables.

- In maturity factoring, the factoring agency does not provide any advance to the firm. Instead, the bank collects the sum from the customer and pays to the firm, either on the date on which the amount is collected from the customers or on a guaranteed payment date.

Procedure

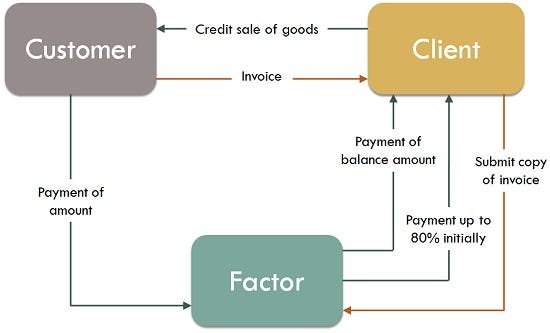

- The seller sells the goods to the buyer and raises the invoice on the customer.

- The seller then submits the invoice to the factor for funding. The factor verifies the invoice.

- After verification, the factor pays 75 to 80 percent to the client/seller.

- The factor then waits for the customer to make the payment to him.

- On receiving the payment from the customer, the factor pays the remaining amount to the client.

- Fees charged by factor or interest charged by a factor may be upfront i.e. in advance or it may be in arrears. It depends upon the type of factoring agreement.

- In case of non — recourse factoring services factor bears the risk of bad debt so in that case factoring commission rate would be comparatively higher.

- The rate of factoring commission, factor reserve, the rate of interest, all of them is negotiable. These are decided depending upon the financial situation of the client.

The factor gets control over the client’s debtors, to whom the goods are sold on credit or credit is extended and also monitors the client’s sales ledger.

Thanks for taking out your time to read this blog.I hope you all must have gained some knowledge .

Thanks again.